- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  Financial Data

Financial Data  Performance Analysis

Performance Analysis

Performance Analysis

As of March 2024

Analysis of Consolidated Statement of Income (Years ended March 31)

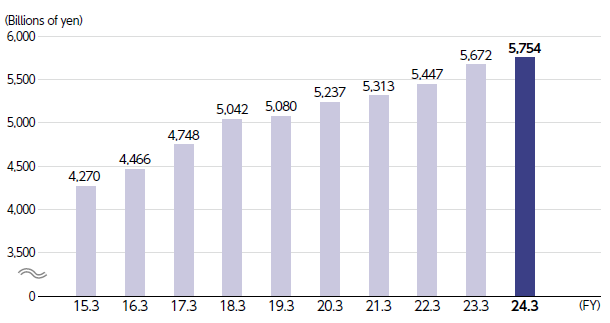

Operating Revenue

Although energy business revenue and mobile communications revenue (including roaming revenue, etc.) declined, operating revenue increased by 1.5% year-on-year to ¥5,754.0 billion due to increase in revenues from growth in the NEXT core business, which consists of corporate DX, business DX, and business infrastructure services.

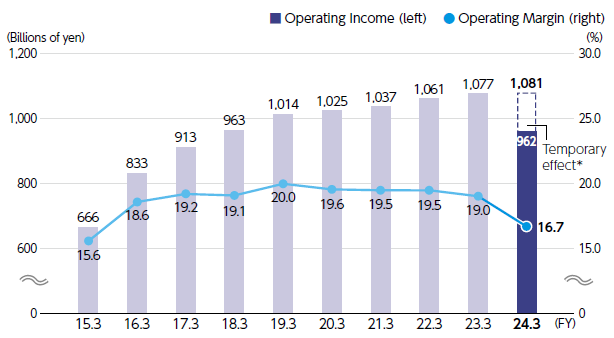

Operating Income

Despite an increase in revenues from growth in the NEXT core business, operating income decreased by 10.7% year-on-year to ¥961.6 billion due to the provision for lease receivables for the Myanmar telecom business and impairment and provision for removal of low-utilized telecom equipment, and a decrease in mobile communications revenue (including roaming revenues, etc.).

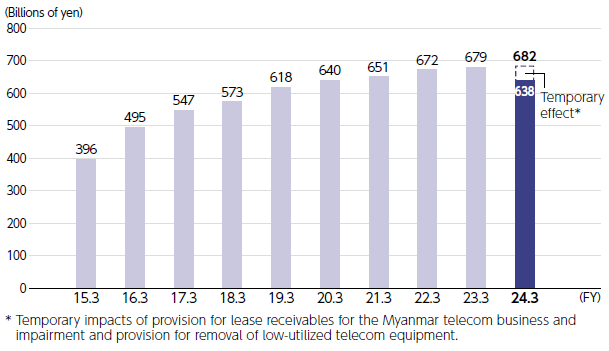

Profit for the Year Attributable to Owners of the Parent

Due to the decrease in operating income, profit for the year attributable to owners of the parent decreased by 6.1% year-on-year to ¥637.9 billion.

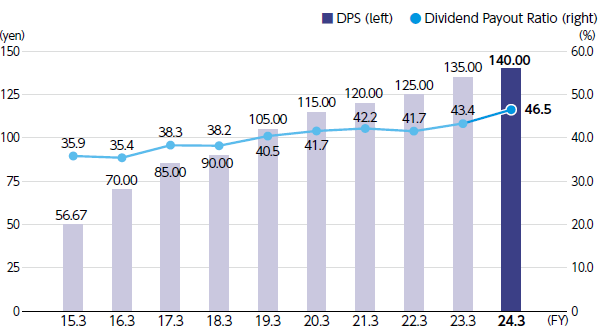

Dividends per Share

The annual dividend was ¥140, an increase of ¥5 year-on-year, and the consolidated dividend payout ratio was 46.5%. For FY25.3 we plan to increase the dividend per share (DPS) by ¥5 to ¥145 and aim for 23 consecutive periods of DPS growth.

Interest-Bearing Debt (figures in parentheses exclude the financial business)

Due to an increase in borrowings, etc., interest-bearing debt increased by ¥743 billion compared to the end of the previous fiscal year (an increase of ¥333 billion excluding the financial business), reaching ¥2,394.4 trillion (¥1,873.3 trillion).

D/E Ratio

Due to the increase in interest-bearing debt, the D/E ratio increased by 0.13 year-on-year to 0.46 times.

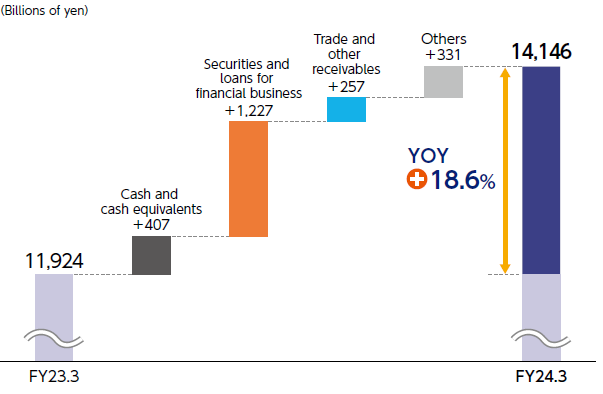

Total Assets

Total assets increased by ¥2,222.5 billion year-on-year to ¥14,146.1 billion, due to an increase in loans for the financial business, and cash and cash equivalents, despite a decrease in assets related to retirement benefits.

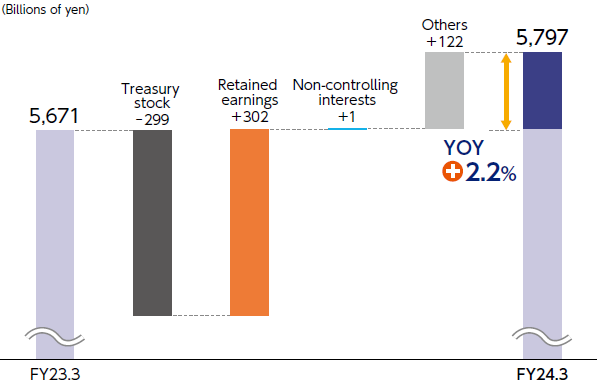

Total Equity

Mainly due to an increase in equity attributable to owners of the parent, total equity increased to ¥5,797.2 billion.

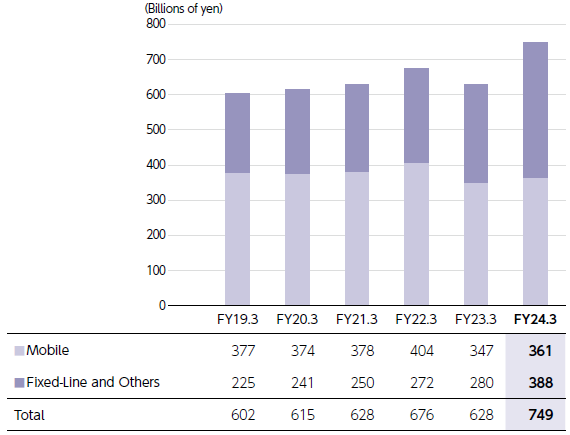

Capital Expenditures (Payment Basis)

Mainly due to an increase in expenditures for the acquisition of tangible fixed assets related to the data center business in Canada, capital expenditures increased by ¥121.8 billion year-on-year to ¥749.3 billion.

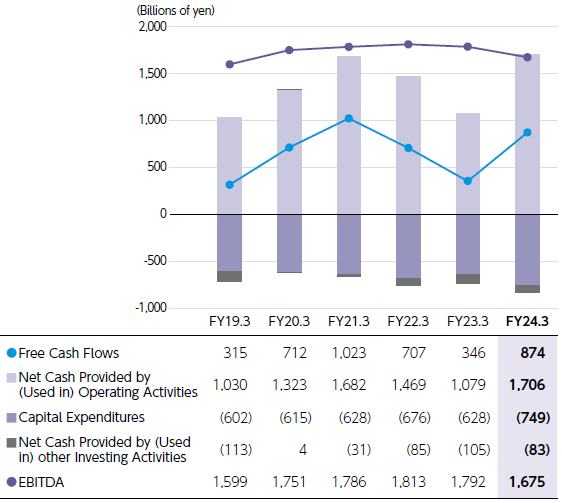

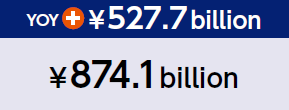

Free Cash Flows

Net cash provided by operating activities (revenue) increased by ¥627.6 billion year-on-year to ¥1,706.5 billion, mainly due to a large increase in deposits in finance business, despite an increase in loans and trade receivables such as installment receivables etc. for financial business and other receivables.

Cash flow used in investing activities (expenditure) increased by ¥100.0 billion year-on-year to ¥832.4 billion, mainly due to an increase in expenditures for the acquisition of tangible fixed assets related to the data center business in Canada.