- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  Financial Data

Financial Data  Result and Forecast

Result and Forecast

Result and Forecast

Consolidated Statement

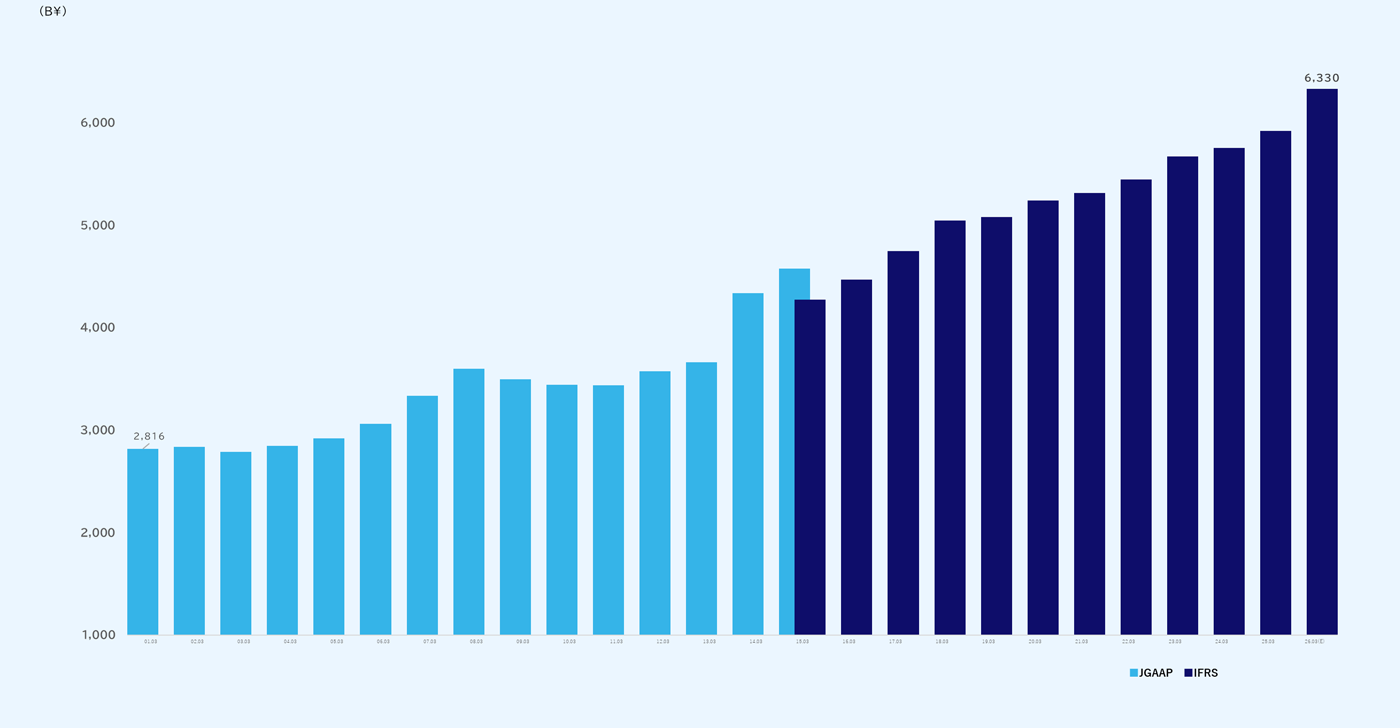

Historical chart Operating revenue

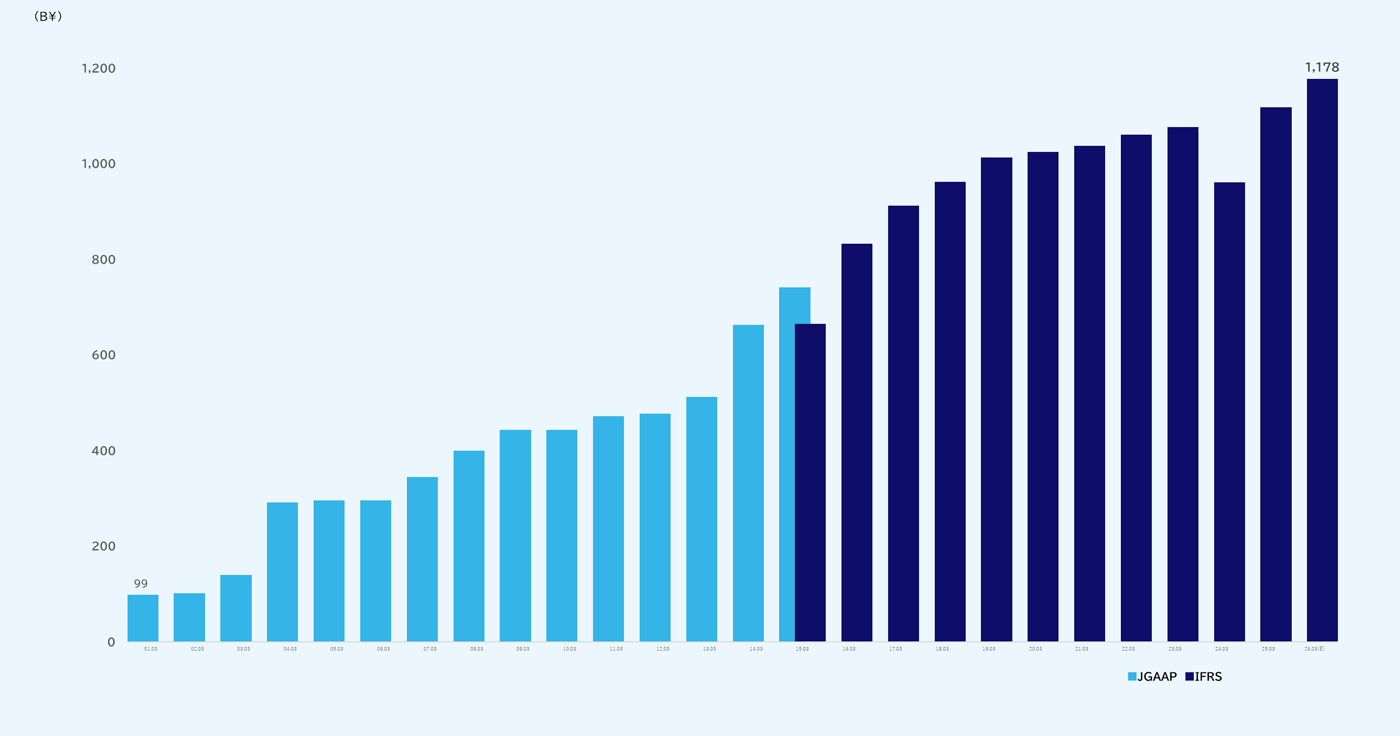

Historical chart Operating income

Consolidated revenue for the fiscal year ended March 2025 were 5,918.0 billion yen, an increase of 2.8% compared to the previous fiscal year. Consolidated operating income increased by 16.3% from the previous fiscal year to 1,118.7 billion yen due to growth driven by Finance, Energy, Lawson, and DX.

The Company projects a consolidated operating revenue of 6,330.0 billion yen (yoy +7.0%) and an operating income of 1,178.0 billion yen (yoy +5.3%) for the fiscal year ending March 2026.

Performance by Business segment

- Results for FY 3/2025

-

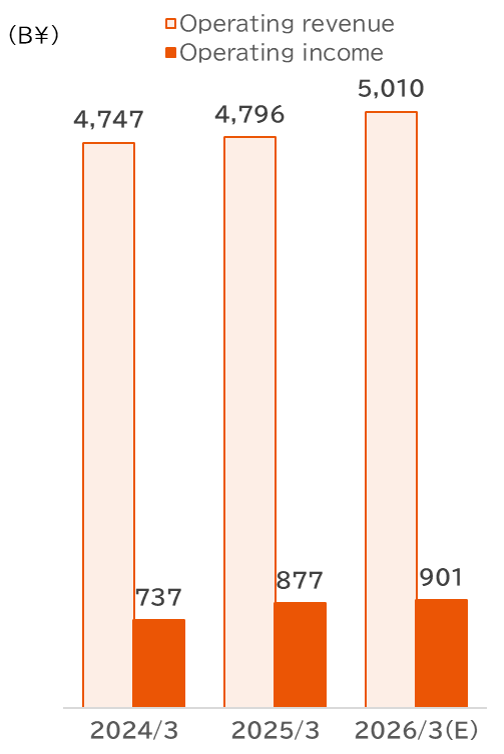

The communications ARPU revenue continued its upward trend, and the focus areas of Finance and Energy also contributed to increased income. Additionally, Lawson's strong performance contributed to the overall income increase, resulting in 19.0% year-over-year increase.

- Forecast for FY 3/2026

-

We aim to achieve operating revenue of 5.1 trillion yen (yoy +4.5% ) and an operating income of 901 billion yen (yoy +2.7%) while continue the challenge to create value that exceeds customer expectations and to improve LTV (customer lifetime value).

- Results for FY 3/2025

-

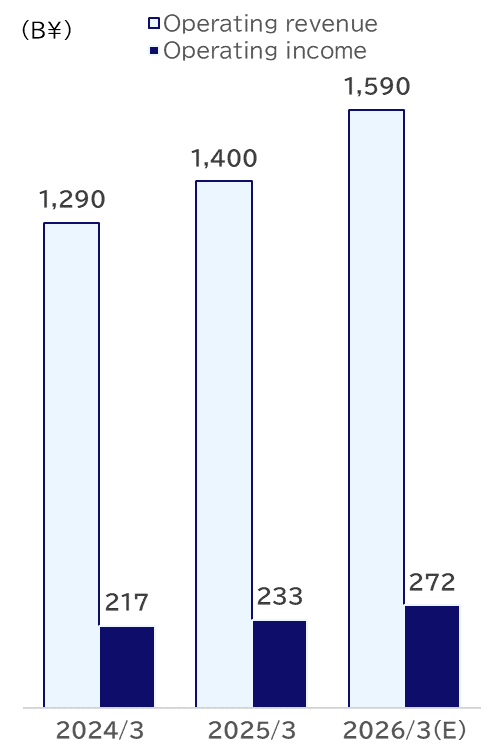

Growth area achieved YOY double-digit revenue increase and resulting in profit growth 7.4% year on year.

- Forecast for FY 3/2026

-

Shifting resources to growth areas such as IoT-related services and data centers, which drive high-profit growth based on a solid telecommunications foundation. We aim to achieve operating revenue of 1.59 trillion yen (yoy +13.6%) and an operating income of 272 billion yen (yoy +16.7%), aiming for double-digit growth in both revenue and income.

- *From FY 3/26, we have changed some business division segments from "Personal Services Segment" and "Others" to "Business Services Segment". In accordance with this, stated figures for FY 3/26 forecast reflect reclassification of segment.

For more detailed financial information, please refer to the "Financial results presentation".