- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  IR Documents

IR Documents  Integrated Report

Integrated Report  Selected Pages of Integrated Report (2017)

Selected Pages of Integrated Report (2017)  Message from the President

Message from the President

Message from the President

KDDI is accelerating its transformation into a "Life Design Company" that provides customer experience value, aiming for even greater reinforcement of corporate value through continuous profit growth and the enhancement of shareholder returns.

Takashi Tanaka

President, KDDI CORPORATION

September 2017

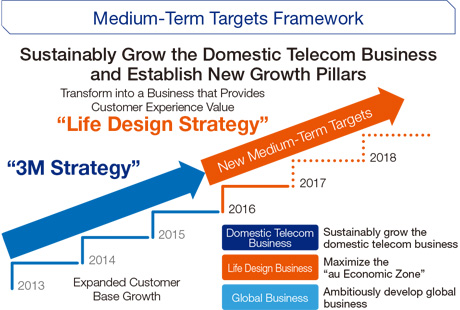

01. First Year of the Medium-Term Targets for the Fiscal Year Ending March 2019

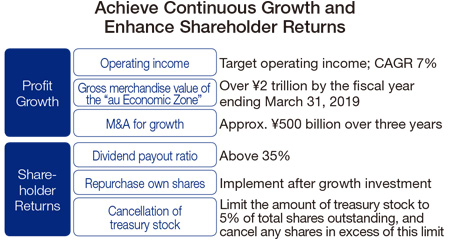

KDDI has set a medium-term target for the three-year period from the fiscal year ended March 31, 2017 to the fiscal year ending March 31, 2019 for transforming into a "Life Design Company" that provides customer experience value. Based on the three business strategies of "sustainable growth in the domestic telecommunications business," "maximize the 'au Economic Zone,'" and "ambitiously develop global business," KDDI aims to both achieve sustainable growth and enhance shareholder returns.

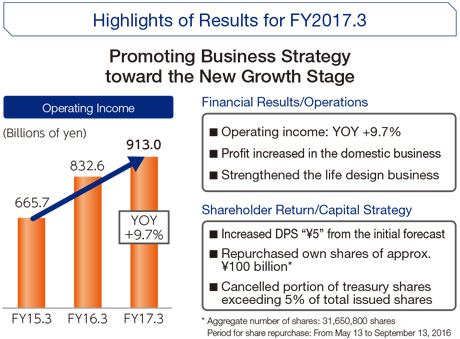

In the fiscal year ended March 31, 2017, the first fiscal year of the new medium-term targets, the domestic business led increases in the Group's earnings. Mobile communications revenues increased in the domestic telecommunications business, accompanied by strong performances in the Value Services segment, which offers a variety of non-telecommunications services to the au consumer base, and the Business Services segment, which provides diverse solution services to corporate customers. Furthermore, as we worked toward our transformation into a "Life Design Company," we focused on strengthening our life design services, including the start of retail electric power sales and a significant expansion in financial services and commerce.

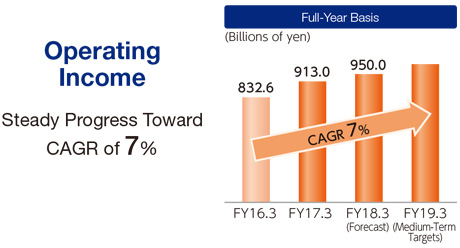

As a result, operating revenue was ¥4,748.3 billion (up 6.3% year on year) and operating income was ¥913.0 billion (up 9.7%), as we marked a strong start in the first fiscal year of our medium-term targets.

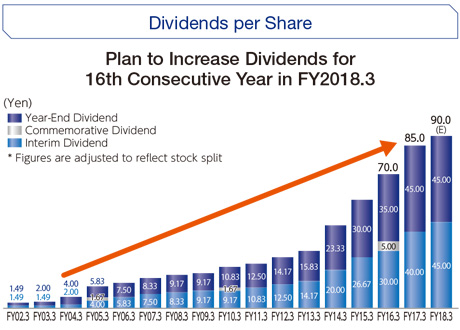

With regard to shareholder returns, we increased dividends per share by ¥15 over the previous year to ¥85, bringing the dividend payout ratio up to 38.3%. Further, implementation of a buyback of around ¥100 billion of our own shares brought our total return ratio to 56.5%.

Changes in the Environment for the Domestic Telecommunications Business

The fiscal year ended March 31, 2017 was marked by significant changes in the business environment for the domestic telecommunications market. These included the increased homogeneity of services provided by mobile carriers, the growth in popularity of low-priced SIM services through MVNOs [1], as well as institutional changes such as issuance of Ministry of Internal Affairs and Communications guidelines for normalizing handset sales prices. These changes have forced mobile carriers to undertake a broad reexamination of their traditional business models. Moreover, we have entered an age of cross-industry competition with mobile operators expanding their business domains into fields other than telecommunications in a bid to secure new sources of earnings, while various companies enter the mobile communications market following the expansion of MVNOs.

Under these circumstances, KDDI has steadily implemented a variety of initiatives in accordance with its three business strategies.

(1) Sustainable growth in the domestic telecommunications business

In the domestic telecommunications business, KDDI aims to maximize communications revenue by continuing to expand "IDs (number of au customers) x ARPA (Average Revenue per Account)."

In the three years through the fiscal year ended March 31, 2016, KDDI succeeded in expanding its customer base amid a background of a shift from feature phones to smartphones, by promoting services that embody the 3M Strategy (Multi-network, Multi-device, Multi-use) that is central to its domestic business strategy. These included "au Smart Value" (discounts for bundled mobile and fixed-line communications services) and "au Smart Pass" (value-added services for au smartphones).

Going into the fiscal year ended March 31, 2017, however, changes in the business environment saw customer flow between the three mobile network operators (MNOs) shrink, while the MVNO market expanded, making it more difficult to increase our customer base. Given these changing conditions, KDDI began work on a number of new initiatives.

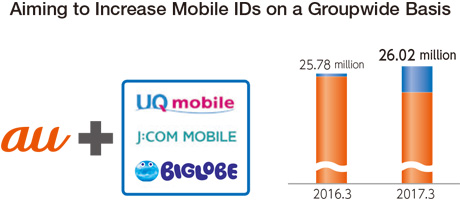

Increasing the Number of Mobile IDs

In a market environment characterized by the continued rise in popularity of MVNOs, KDDI is working to capture new customers by leveraging the unique initiatives and strengths of its individual companies in MVNO services offered by Group companies such as UQ Communications Inc. and Jupiter Telecommunications Co., Ltd. under their respective UQ mobile and J:COM MOBILE brands.

Also as part of expanding its customer base, in January 2017, KDDI made BIGLOBE Inc., which operates an Internet connection service as well as MVNO, FTTH and other businesses, a wholly owned subsidiary. This has increased customer numbers of the Group as a whole and enabled KDDI to acquire new customer touchpoints.

As a result of these efforts, the number of mobile IDs at the fiscal year-end, the total of au subscribers and Group MVNO subscribers, increased by around 230,000 year on year. We will continue working to expand the number of mobile IDs on an au + MVNO basis.

Strengthening au Retention

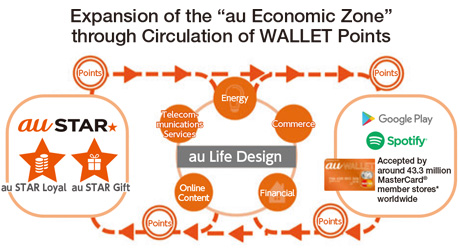

In August 2016, KDDI launched the new free subscriber program "au STAR" as one of our initiatives for the medium-term target business strategy of "transforming into a business that provides customer experience value." "au STAR" is designed to encourage customers to use au services for the long term, and offers three special benefits. One of these, "au STAR Loyal," rewards longtime subscribers with WALLET points each month, depending on the number of years they have used au and their fixed-rate data fees. By building a circulation model for WALLET points within the "au Economic Zone," we will work to strengthen au customer retention and maximize the "au Economic Zone."

KDDI also focused on enhancing customer support, in part through "au Smart Support," a unique service that assists customers to provide a more enjoyable experience when using au mobile services, either through in-home visits or by telephone and remote control.

Furthermore, in July 2017, KDDI also introduced a new rate plan to counteract the outflow of au customers to the MVNO market. The plan offers advantages to a wide range of customers, primarily those who prefer lower-priced monthly fees and those who use their devices for longer periods regardless of data usage volume. We expect this plan will also help to strengthen au customer retention.

To ensure KDDI continues to be the preferred choice of customers, we will work to provide customer experience value by steadily advancing these efforts.

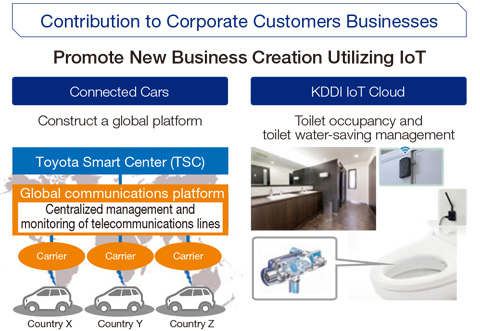

Creating New Business Utilizing IoT

KDDI is also focused on its efforts in IoT, a future growth sector. In June 2016, we entered into a partnership agreement with Toyota Motor Corporation related to "connected cars." We are now building a global communications platform designed to provide high-quality, reliable telecommunications on a global scale which will be available to other enterprises as an open platform to promote its spread.

KDDI has also begun providing new services utilizing IoT. The KDDI IoT Cloud "Toilet Water-Saving Management" service announced in February 2017 uses human perception sensors and other technology to automatically control water volume, making it possible to manage toilet water savings.

Additionally, KDDI has put a variety of platforms in place to build a new business model as a telecommunications operator in the IoT era. We are making steady progress in preparing to roll out a full-scale IoT business, including consolidation of iret, Inc., which has strengths in providing end-to-end cloud-related services from deployment design and early build-out to maintenance, and the establishment of ARISE analytics Co., Ltd. through a joint venture with Accenture Japan Ltd., which has extensive expertise in the field of data analytics.

With the coming of the IoT era, in which all things will be connected to the Internet, the KDDI Group is bringing together its cumulative strengths and utilizing IoT to create new businesses with the goal of contributing to business growth for its corporate customers across every field of industry.

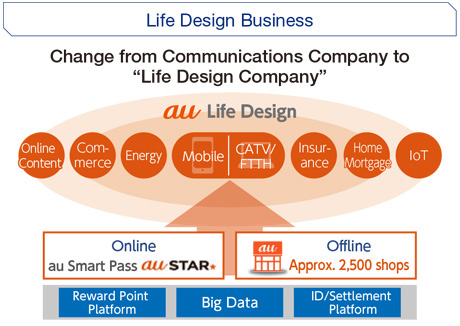

(2) Maximize the "au Economic Zone"

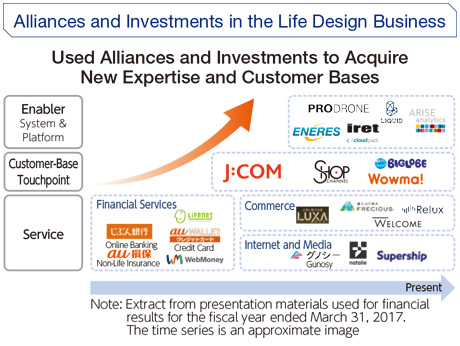

KDDI has achieved significant growth in income even in an intensely competitive environment with the expanding domestic mobile market and rising smartphone penetration rates. As the domestic telecommunications business, the leading driver of that growth, shifts to a more stable growth phase, we now aim to maximize the "au Economic Zone" as a means to establishing new pillars for growth in fields of non-telecommunications. To achieve this, we plan to fully develop the life design business, offering a comprehensive range of services that are closely tied to everyday life and are aligned with each customer's stage in life. In doing so, we will build on our solid base of au customers, whose contracts include rigorous identification procedures, and our "au Simple Payment" and "au WALLET" settlement services. In addition, KDDI is promoting an omni-channel approach by further strengthening its customer contact points, including "au Smart Pass" and "au STAR" for online services, and its au shops as real stores for offline services.

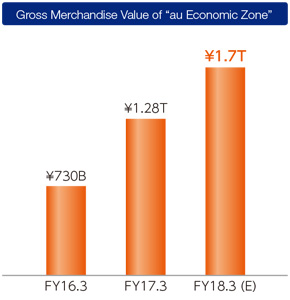

Approaching Gross Merchandise Value of above ¥2 Trillion in the "au Economic Zone"

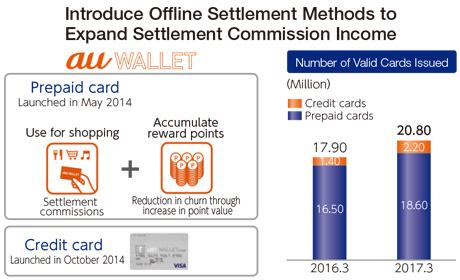

As of the end of March 2017, "au Smart Pass" [2] membership exceeded 15 million, and the number of valid "au WALLET" cards (prepaid cards + credit cards) grew to exceed 20 million cards.

As part of an effort to expand the "au Economic Zone" by strengthening its life design business, KDDI launched various new life design services. These include "au Denki," in conjunction with the April 2016 liberalization of the electricity retail market, and "au Insurance & Loans," which are au-branded financial services offered through collaboration with Group companies. Furthermore, in product sales we offer "au WALLET Market," which provides KDDI's carefully selected assortment of premium products, TV shopping services provided by Jupiter Shop Channel Co., Ltd., which was consolidated in March 2016, and the new "Wowma!" online shopping mall. At the same time, we have been promoting collaboration between a variety of services and WALLET points.

KDDI offers a variety of opportunities to accumulate WALLET points, including through payment of au mobile phone and other communications fees, monthly points given to customers through "au STAR Loyal," and points given for shopping payments using "au WALLET." Accumulated points can be used to purchase au devices and pay for telecommunications fees, as well as pay "au WALLET" credit card bills, recharge "au WALLET" prepaid cards, and even as cash at 43.3 million MasterCard (R) member stores [3] worldwide. KDDI hopes to expand the gross merchandise value of the "au Economic Zone" by enabling its customers to use these highly convenient WALLET points throughout a variety of everyday situations, thus creating a model for circulation within the "au Economic Zone."

As a result of these efforts, gross merchandise value of the "au Economic Zone" in the fiscal year ended March 31, 2017 was brisk at ¥1.28 trillion, exceeding our plan.

KDDI will continue working to expand and offer attractive services aiming to reach above ¥2.0 trillion in gross merchandise value of the "au Economic Zone" in the fiscal year ending March 31, 2019.

(3) Ambitiously develop global business

Taking into account long-term issues facing the domestic telecommunications market in Japan―declining birthrates, an aging society, and a shrinking population―it is essential that KDDI establish new pillars for growth in global business.

KDDI's global operations consist of two core businesses: 1) the global consumer business, which primarily entails telecommunications services for individual customers mainly in emerging countries, and 2) the global ICT business, which provides overseas corporate customers with data centers as a core, together with high-bandwidth, highly reliable networks that span the entire world, as well as systems integration services for ICT environments.

In the fiscal year ended March 31, 2017, the impact of a strong yen in excess of initial assumptions, and the liquidation of certain low-profitability businesses deemed unlikely to deliver future growth, brought a year on year decline in both revenue and income in global operations. Nevertheless, KDDI made steady progress in its efforts to establish new growth pillars.

Efforts to Expand the Telecommunications Business in Emerging Countries

In the Myanmar telecommunications business, which we entered in 2014, we utilized the experience and technology accumulated through our consumer business in Japan to increase the number of mobile base stations, expand area coverage for high-speed data networks, and improve telecommunications quality through area optimization, among other measures. As a result of these efforts, mobile subscribers increased to approximately 24 million subscribers as of the end of June 2017 from approximately 6 million subscribers at the end of July 2014, when we entered into our joint operating agreement with Myanma Posts & Telecommunications (MPT). ARPU, which had continued to trend downward as competition with rival companies intensified, has also begun to stabilize since the fiscal year ended March 31, 2017.

Additionally, in May 2017, MPT became the first telecommunications operator in Myanmar to begin offering a 4x4 MIMO (Multiple Input, Multiple Output) compatible LTE service using its newly acquired 1.8 GHz band. The service is first being offered in Yangon, Mandalay and Naypyidaw, Myanmar's three largest cities, and by the end of September 2017, KDDI plans to extend the coverage area to 30 major cities nationwide. Demand for SNS and video streaming services is increasing in Myanmar, and we can expect to see the effects of widespread rich content utilizing the features of high-speed telecommunications in bolstering data ARPU.

In the telecommunications business in Mongolia, consolidated subsidiary MobiCom Corporation LLC launched 4G LTE service in the capital of Ulaanbaatar in May 2016, and is moving forward with other efforts to generate growth.

In both Myanmar and Mongolia, KDDI aims to continue being the No. 1 telecommunications carrier as the first choice of local customers. We will continue to seek out new business opportunities in emerging countries in Asia with growth potential.

Strengthening and Expanding a Platform for the Data Center Business Centered in Europe

KDDI's "TELEHOUSE" data center business operates in 13 countries and regions, 24 cities, and 48 sites around the world. The data center business has built an extremely strong reputation among customers in Japan and overseas for its high levels of connectivity, reliability, and quality. In particular, the data center in London offers one of the highest numbers of connections in the U.K., and we are working to strengthen and expand our business base with the full opening of TELEHOUSE LONDON Docklands North Two in November 2016, which uses cutting-edge environmental technology.

KDDI will continue promoting high-quality services, centered in Europe where its service offering is particularly competitive.

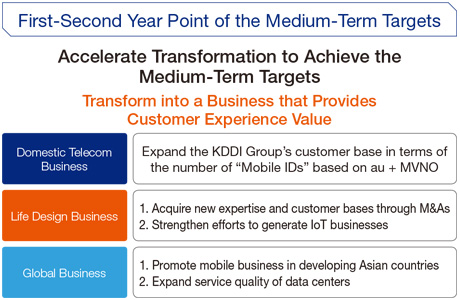

02. Acceleration of Transformation into a "Life Design Company" in the Second Year of the Medium-Term Targets

In the fiscal year ending March 31, 2018, the second year of the medium-term targets, KDDI will push further ahead with its three business strategies, accelerating its transformation into a "Life Design Company."

The forecast for operating income in the fiscal year ending March 31, 2018 is for a year-on-year increase of 4.1% to ¥950 billion. This is below the medium-term target compound annual growth rate (CAGR) of 7%, because the forecast factors in approximately ¥50 billion for strategic costs aimed at sustainable growth. KDDI plans to apply these funds primarily to efforts to further strengthen au customer retention in the face of the major environmental changes in the domestic telecommunications business, as well as to ramping up efforts to strengthen its commerce business and reform its sales channels as it works toward transforming into a "Life Design Company."

KDDI is working to respond swiftly to changing conditions, while implementing measures needed to achieve its medium-term targets by the fiscal year ending March 31, 2019 and achieve sustainable growth in the fiscal year ending March 31, 2020 and beyond.

Cash Allocation and Policy on Shareholder Returns

In its use of cash, KDDI places the highest priority on growth investment aimed at achieving sustainable income growth. We are steadily making these investments, including capital investments intended to maintain and strengthen competitiveness, and investments in maximizing the "au Economic Zone" and ambitiously expanding global business, primarily through M&As, as both are positioned as future pillars of new growth.

In the fiscal year ending March 31, 2018, KDDI expects to make ¥530 billion in capital investments, primarily to improve LTE quality and expand area coverage. We plan to maintain investments at similar levels in the medium to long term.

At the same time, we will conduct M&As aimed at business growth, with a focus on strengthening Group competitiveness across a variety of sectors, based on a plan for a cumulative three-year total investment of ¥500 billion by the fiscal year ending March 31, 2019. We will work to acquire new expertise and expand our customer base by actively moving ahead with M&As and business tie-ups. KDDI continues to make investment decisions based on careful examination of every growth opportunity and risk factor.

Regarding shareholder returns, KDDI has a basic policy of maintaining financial soundness and continuing to pay stable dividends. For the three years until the fiscal year ending March 31, 2019, KDDI has committed itself to a minimum dividend payout ratio of above 35%. We plan to continue increasing dividends as EPS expands alongside continued profit growth. In the fiscal year ending March 31, 2018, KDDI plans to distribute an annual dividend of ¥90 per share, an increase of ¥5 per share compared with the previous fiscal year for a dividend payout ratio of 39.2% and the 16th consecutive year of dividend increases.

KDDI will conduct share buybacks balanced with its growth investments. KDDI has disclosed it will buy back ¥100 billion of its own shares in the fiscal year ending March 31, 2018, following a buyback of the same scale in the previous fiscal year. KDDI aims to limit treasury stock to 5% of total shares outstanding, and will regularly cancel any shares in excess of this amount. On May 17, 2017, KDDI cancelled treasury stock equivalent to 1.27% of the total number of issued shares.

03. CSR Management Starts with the KDDI Group Philosophy

By following the "KDDI Group Philosophy," KDDI aims to be a company appreciated and trusted by all of its stakeholders. As a telecommunications carrier managing social infrastructure that must work under all sorts of conditions, 24 hours a day, 365 days a year, KDDI has the vital mission of providing reliable communications services to society. The telecommunications business could not exist without being able to borrow radio waves and other valuable assets that belong to the public. We are therefore aware of our social responsibility to help solve problems faced by society with high aspirations. The "KDDI Group Philosophy" defines our corporate posture and how our employees should tackle issues at work. I believe that it is also the starting point for CSR management.

As we have ambitiously developed global business in recent years, it has been essential that all of our employees take action with a shared set of values to generate synergies and strengthen ties between each business division. In conjunction with the revision of the "KDDI Group Philosophy" in 2013, KDDI has conducted awareness-raising activities for employees inside and outside Japan to help spread the philosophy. We will promote CSR management by pursuing our mission together as a group of employees that share the "KDDI Group Philosophy."

04. In Conclusion

For the fiscal year ending March 31, 2018, we will steadily implement steps aimed at achieving our medium-term targets as we continue to aim for growth in both sales and profits.

Even as business conditions grow increasingly challenging, we will resolutely take on new challenges for sustainable growth, accelerating our transformation into a "Life Design Company" that offers experience value that exceeds customer expectations. With an even stronger sense of urgency, we will keep our concerted Companywide efforts toward improving our corporate value.

- Other IR Information

- Recommended Contents

-