- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  IR Documents

IR Documents  Integrated Report (Back number)

Integrated Report (Back number)  Selected Pages of Integrated Report (2017)

Selected Pages of Integrated Report (2017)  The Japanese Market and KDDI

The Japanese Market and KDDI

The Japanese Market and KDDI

Shifting from a Telecommunications Company to a "Life Design Company"

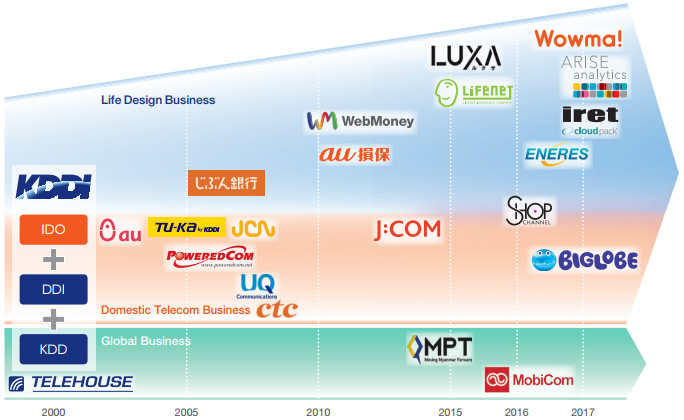

The KDDI CORPORATION was established in October 2000 through the merger of DDI CORPORATION, a long-distance communications company; KDD Corporation, an international communications company; and IDO CORPORATION, which provided mobile communications.

Thereafter, we have expanded our base through mergers, and continued to grow as a comprehensive telecommunications company with both mobile and fixed-line operations.

Today in Japan, KDDI is working to secure new revenue streams, utilizing our domestic telecommunications customer base to more actively engage in a variety of initiatives aimed at generating revenue in non-telecommunications fields.

In our global business, we are moving forward with efforts to establish sustainable growth, such as entering the mobile telecommunications markets in Myanmar and Mongolia.

Principal Businesses of the KDDI Group

Mobile

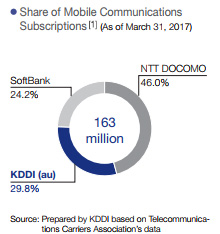

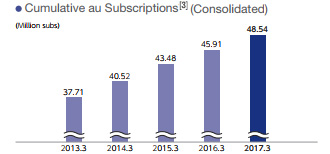

As of March 31, 2017, au mobile subscriptions numbered 48.54 million, up 5.7% year on year and accounting for a 29.8% (+0.5 percent point) share of the mobile market coverage by Japan's three major carriers.

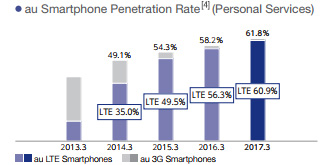

Of this figure, in the Personal Services segment, which provides services for individual customers, au smartphone penetration has risen to 61.8% (60.9% if limited to LTE).

The number of subscribers to the MVNO provided by a consolidated subsidiary has also increased by 770,000 over the previous year to 870,000 subscriptions. Going forward, we will work to expand the number of mobile IDs based on au + MVNO.

Fixed-Line Broadband

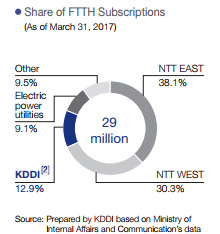

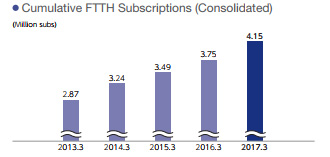

As of March 31, 2017, the cumulative number of FTTH subscriptions stood at 4.15 million, up 10.5% year on year, in part due to the consolidation of BIGLOBE Inc., and accounting for a market share of 12.9%.

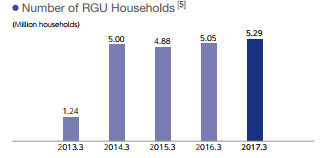

In CATV services, the number of RGU households as of March 31, 2017 stood at 5.29 million, up 4.6% year on year.

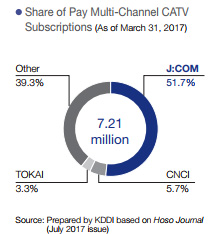

Note that KDDI's share of J:COM multi-channel pay CATV subscriptions as of March 31, 2017 stood at around 50%.

By cross-selling FTTH and CATV services to the au customer base, we expect the KDDI Group customer base to continue growing stronger and expanding.

Non-Telecommunications Field

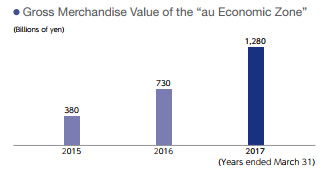

KDDI is increasing its efforts to establish a new source of growth by maximizing the "au Economic Zone."

In the online domain, the "au Economic Zone" consists primarily of "au Smart Pass" and other digital content, while offline, it comprises product sales, electric power, finance and other life design services. The amount of these services used, along with the total of payments made through means provided by KDDI ("au Simple Payment" and "au WALLET") together amount to total transaction volumes in the "au Economic Zone."

In the fiscal year ended March 31, 2017, the gross merchandise value of the "au Economic Zone" rose by 75.3% year on year to ¥1.28 trillion.

- Recommended Contents

-