- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  IR Documents

IR Documents  Integrated Report

Integrated Report  Integrated Report 2019 (Online Version)

Integrated Report 2019 (Online Version)  Medium-Term Management Plan (FY2020.3-FY2022.3)

Medium-Term Management Plan (FY2020.3-FY2022.3)

Medium-Term Management Plan (FY2020.3-FY2022.3)

Medium-Term Management Plan (FY2020.3-FY2022.3)

We aimed for continuous growth and enhance shareholder return by offering customer experience value which goes further than expected and it has brought us a secured solid customer base and a steady growth in consolidated operating income up to now.

From now on, full-scale digitization is speeding onward against the backdrop of continual technological advances encompassing 5G (5th Generation Mobile communications System), and it will bring us big changes in the competitive environment of Japans telecommunications market.

Amid this age of epochal change, KDDI drew up a new three-year medium-term management plan (FY2020.3-FY2022.3) to realize "the integration of telecommunications and life design."

Sustaining Profit Growth and Further Strengthening Shareholder Returns

Since its establishment in October 2010, KDDI has achieved 18 straight years of growth in operating income, with its strengths as a comprehensive communications carrier translating into continued business growth. KDDI has also focused on enhancing shareholder returns, increasing dividends for 17 fiscal years in a row.

Under the new medium-term management plan unveiled in May 2019, KDDI targets growth of 1.5 times in earnings per share (EPS) by the fiscal year ending March 31, 2025, compared with the level in the fiscal year ended March 31, 2019, while sustaining growth in profits.

Regarding shareholder returns, KDDI has steadily increased dividends toward a dividend payout ratio of at least 40%, while taking a flexible approach to buying back its own shares.

In principle, KDDI retires all the shares it buys back. Through these initiatives, we intend to continue balancing sustained profit growth with stronger shareholder returns.

Our Growth Story

01: Earnings expansion via "the integration of telecommunications and life design"

Although growth is gradually tapering off in the domestic mobile communications business, KDDI aims to sustain expansion by offering faster communications speeds and encouraging greater use of rich content in the coming 5G era.

Furthermore, KDDI will aggressively move forward on its growth strategy for "the integration of telecommunications and life design," with the aim of increasing earnings alongside growth in the life design domain.

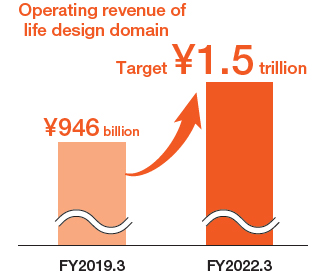

KDDI is keen to expand both operating revenue and operating income in the life design domain, with growth driven by commerce, energy, finance, and other services.

02: Operating revenue expansion via the strengthening of growth domains

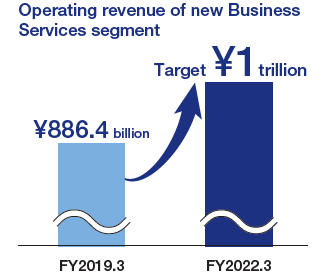

Under our new medium-term management plan, we have positioned the new Business Services segment as a pillar of growth to accompany the life design domain.

In the new Business Services segment, KDDI aims to increase the total number of IoT connections from eight million as of March 31, 2019 to 18 million by March 31, 2022, by creating recurring business centered on IoT operations and providing various business platforms in Japan and other countries around the world.

In both growth domains, KDDI is focusing on the targets it set for increasing operating revenue in the life design domain from ¥946 billion in the fiscal year ended March 31, 2019, to ¥1.5 trillion by the fiscal year ending March 31, 2022, and expanding operating revenue in the new Business Services segment from ¥886.4 billion to ¥1.0 trillion over the same time frame.

Business Expansion through Collaboration with Partners

03: Capital expenditures and cost reductions

Over the course of the previous medium-term management plan, KDDI spent about ¥1.68 trillion on capital investments, mainly for maintaining and expending its 4G network. Under the new medium-term management plan, management intends to keep annual capital investment at a little over ¥600 billion, including investments in 5G that are ramping up this fiscal year.

To sustain profit growth at the same time, KDDI is keen to reduce costs through the use of technology and the adoption of new ideas that are not bound to conventional thinking.

Specifically, KDDI is advancing measures to increase business efficiency through systemization and the reform of work processes as well as improvements in the cost efficiency of network operations through the use of network virtualization and AI. Management targets a total of ¥100 billion in cost reductions over the next three years that will translate into stronger profit growth.

- Integrated Report 2019 (Online Version)

- Interview with Management

- Realizing Sustained Growth and Medium- and Long-Term Improvement in Corporate Value

- The Path of Value Creation

- Risks and Growth Opportunities

- Medium-Term Management Plan (FY2020.3-FY2022.3)

- Special Feature: Aiming for a New Stage of Growth

- The Integration of Telecommunications and Life Design

- New Growth Opportunities and Solutions for Social Issues with 5G

- Business Expansion through Collaboration with Partners

- Messages from Outside Directors

- KDDI's Sustainability

- Activities by Segment: Personal Services Segment

- Activities by Segment: Life Design Services Segment

- Activities by Segment: Business Services Segment

- Activities by Segment: Global Services Segment

- The Japanese Market and KDDI: Characteristics of the Domestic Market

- The Japanese Market and KDDI: KDDI's Domestic Status

- Other IR Information

- Recommended Contents

-