CFO Message

Management Strategy with Sustainability Management at the Core

There is a growing interest in ESG initiatives in the stock market. With Sustainability Management at the core, KDDI aims to achieve together with our partners a virtuous cycle of corporate value improvement and sustainable growth in society.

In the past, we have honed our non-financial initiatives, including the provision of a resilient telecommunications environment through our disaster countermeasures and the human resource development through activities for the penetration of KDDI Group Philosophy within the company. When formulating our Mid-Term Management Strategy, we selected six material issues based on topics of interest for multi-stakeholders including long-term investors, our vision, and the impact on our business. They incorporate aspects such as the promotion of innovation required for our business transformation, enhancement of human resources and governance in step with the diversification of our businesses, and response to the international society's growing concerns about climate change and other issues.

At the same time, we have defined for each materiality the "Eight values we embrace," the different types of values we need to provide to society. We have also set a total of 25 mid-term sustainability targets (KPIs) to work toward for the respective values to be provided.

As interest in ESG rises, so do expectations for the visualization of capital expenditures and non-financial capital.

Therefore, we will step up our efforts to disclose information closely related to our long-term strategy. Please also keep an eye on the initiatives for strengthening of management base needed to promote the Satellite Growth Strategy as well as our mid-term sustainability targets.

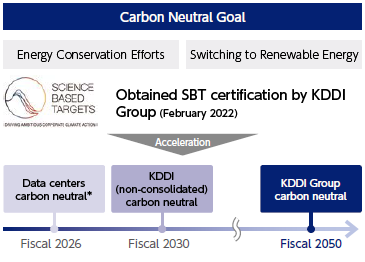

Toward the Achievement of Carbon Neutrality

We aim to make our business activities carbon neutral by fiscal 2030. In addition, we will endeavor to achieve net-zero CO2 emissions for all Telehouse brand data centers around the world by fiscal 2026, and for the entire KDDI Group by fiscal 2050.

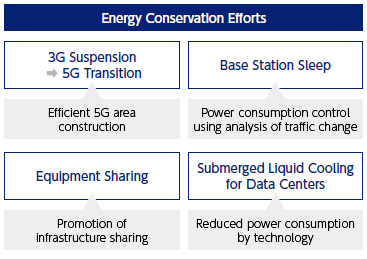

We will also respond to the growth of 5G traffic by developing technologies for conserving energy. In addition to our 3G suspension at the end of March 2022, we will also work on sharing infrastructure with competitors, adopting various energy-saving technologies to reduce power consumption, and switching to renewable energy.

In addition, we started jointly operating sustainable base stations―which ensure independent power sources using solar power generation and can supply all the electricity necessary for the operation of a single base station during the day on sunny days―with au Energy & Life Inc. in May 2023. Furthermore, we will further accelerate our renewable energy generation business through au Renewable Energy, Inc.―which started business in April 2023―to contribute toward society's carbon neutrality through business.

Enhancement of Group Governance Necessary for Promoting the Satellite Growth Strategy

As we welcome more group companies and diversify our businesses through the promotion of the Satellite Growth Strategy, we are also strengthening the KDDI Group's risk management and information security systems. Specifically, to achieve synergy and growth for the entire group, by expanding the common infrastructure through shared services and establishing a system for training and supporting CFO human resources, we will strengthen our risk management system. Additionally, we will further enhance information security to support business growth by upgrading a privacy governance system for inter-group data connections.

The KDDI Group established the "KDDI Group Human Rights Policy," recognizing that all business activities are based on respect for human rights. To further accelerate our efforts to fulfill our responsibility to respect for human rights, we revised the KDDI Group Human Rights Policy in October 2022.

Accelerating Growth in Focus Areas alongside Human Resources First

The KDDI Group emphasizes human resources, and it is stated in the KDDI Group Mission Statement that the Group "values and cares about the material and emotional well-being of all its employees." In the future, the specialty of each person will become important, and the development of human resources who can play active roles both within and outside the company is also an important initiative for our sustainable growth.

We consider human resources to be our greatest resource. With the aim of transforming KDDI into a "Human Resources First Company" that places the development and enhancement of human resources at the core of its management, KDDI is promoting the unified three-part reform initiatives of "Penetration of new personnel system", "Development of professional human resources through KDDI Version Job Style Personnel System", and "Enhancement of employees' engagement". Moreover, we have defined our transformation into a company that puts human resources first as a materiality. We will leverage a diverse pool of sophisticated professionals and cultivate a culture that embraces challenges so that we can further produce innovation and contribute to the sustainable growth in society.

As a specific target, we will work to raise the professional human resources ratio in all specialized fields to at least 30% by FY25.3. Also, by enhancement of all employees' DX skills and training of DX professionals through the use of KDDI DX University, and expansion of DX basic skills acquisition to KDDI Group, we will shift DX professionals to the focus areas.

Human Resource Development

Maximizing organizational strengths to drive business strategy centered on DX

Cash Allocation and Shareholder Returns

We will continue strengthening our investment in growth and shareholder returns to support our sustainable growth. We will also work to attain operating cash flow (excluding financial business) of 5 trillion yen scale over the mid-term. The operating cash generated will be preferentially allocated to capital expenditures in 5G and focus areas, as well as strategic business investments, for a total investment of around 2 trillion yen. In particular, for the strategic business investment of 700 billion yen, we will focus on projects that will lead to business growth in the future. At the same time, we will undertake investment in growth keeping in mind the improvement of capital efficiency for the KDDI Group as a whole.

Regarding the EPS growth target stated in the Mid-Term Management Strategy, there are issues such as the reduction of telecommunications fees and the impact of high fuel prices. However, we will continue with the pursuit of EPS growth as it is an important vector for both business growth and enhancement of shareholder returns. In May 2023, to show our management's direction, we also enhanced shareholder returns through increasing dividends by five yen as well as establishing an upper limit of 300 billion yen for further repurchase of our own shares.

Furthermore, in October 2022, we issued KDDI Tsunagu Chikara Bonds (unsecured straight bonds), KDDI's first sustainability bonds to deploy funds for projects that address social issues and protect the environment. Going forward, we will continue to promote projects that address social issues and protect the environment, and effectively raise funds in line with Sustainability Management.

Cash Allocation Policy

Continue to strengthen investment in growth and shareholder returns for sustainable growth

Cost Structure Reform

The optimization of expenditure related to telecommunications facilities from the 3G suspension in March 2022 achieved a cost structure reform of approximately 50 billion yen. We will continue to undertake technological cost structure reforms through the promotion of infrastructure sharing, use of advanced technologies, and such, as well as revenue structure reforms for selling costs. Through these efforts, we will promote cost structure reforms in the scale of 100 billion yen in the mid-term (FY23.3 to FY25.3). Going forward, based on the KDDI Group Philosophy, we will continue to practice "Maximizing revenues, minimizing expenses" as well as adhere to lean and mean management.

Today's corporate management is exposed to a variety of risks that are difficult to predict, such as the unstable situation overseas, high fuel prices, and sudden fluctuations of exchange rates. Even in such an environment, KDDI will promote various types of initiatives seeking financial growth in both aspects of revenue and profit. We will therefore undertake the strengthening of management base that balances agile forecasts and resilient preparations. Through the practice of Sustainability Management based on the KDDI Group Philosophy, we will also improve our non-financial value and contribute toward the enhancement of corporate value and sustainable growth in society.

As we carry out the Mid-Term Management Strategy, we will guide our decisions and actions with the valuable insights we gain from dialogue with our shareholders and investors.

- Other IR Information

- Recommended Contents

-