- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  Management Policy

Management Policy  Mid-Term Management Strategy

Mid-Term Management Strategy  Mid-Term Management Strategy (FY23.3-FY26.3)

Mid-Term Management Strategy (FY23.3-FY26.3)

Mid-Term Management Strategy (FY23.3-FY26.3)

At the financial results briefing for the fiscal year ended March 2024 on Friday, May 10th, we announced a review of our medium-term management strategy. Please see here for details.

Financial results briefing for the fiscal year ending March 2024

Amidst the rapidly changing business environment, KDDI has raised new "KDDI VISION 2030: The creation of a society in which anyone can make their dreams a reality, by enhancing the power to connect" to bring about an ideal world. By 2030, we aim to become a platformer supporting society, providing added value in every business and every corner of daily living. Until now, we have been expanding non-telecommunication growth domains by the integration of telecommunications and life design, mainly through smartphones. In the new mid-term strategy, we will drive business reform toward 2030, with Promoting business Transformation Centered on 5G.

In the new mid-term management strategy (FY23.3-FY26.3)

In the new mid-term management strategy (FY23.3-FY26.3), we first devised "New material issues (materiality)" comprehensively highlighting the levels of importance of social issues and KDDI Group management from a long-term perspective. With this in mind, we will strengthen our business strategies and the management foundation that underpins them, with sustainability management as the basis.

As for the basis of sustainability management, the KDDI Group will aim for the sustainable growth of society and advance corporate value together with our partners through driving our business strategies and strengthening our management foundation. We will look to create a positive cycle where the growth of society benefits our business strategies, which will then give back to society.

Business strategies

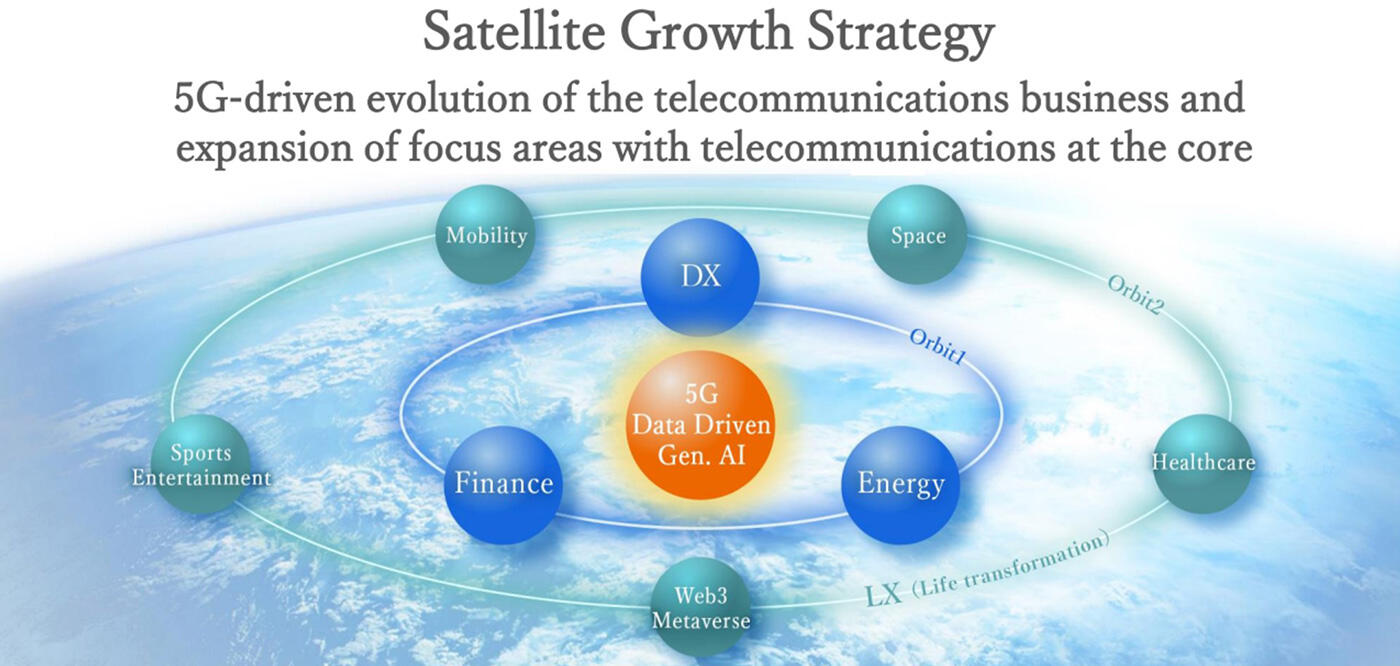

In the new mid-term strategy, we named business strategies "Satellite Growth Strategy." Putting 5G, which is set to expand full-scale, at the center of the strategies, we will advance our telecommunication business and focus areas with telecommunication at the center. Defining the following five domains as focus areas― (1) DX (digital transformation), (2) Finance, (3) Energy, (4) LX (life transformation), and (5) Regional Co-Creation (CATV etc) ―we will accelerate the growth of the new domains, generating synergies with telecommunication at the center. For the long-term outlook of the focus areas, in DX we will utilize group assets mainly through 5G, aiming for a positive cycle of our businesses transforming people's lives. In finance, we will launch B-to-B-to-X businesses by providing platform services, and in energy, VPP businesses and so forth based on data utilization. In LX, with the hope of transforming lifestyles as the step of Life Design, we will transform people's experiences and activities in daily life by promoting 5G penetration and advancing 5G technologies, while for Regional Co-Creation, we will work on solving the digital divide problem. In every domain, we will utilize 5G, which is our strength, and our know-how and partnering from years of experience.

5G

For 5G that will drive growth, we will aim to "blend in" telecommunications to every scene to bring about an era that provides new value with diverse partners. To develop areas that will serve 5G, we will expand in areas where people are likely to go to on a daily basis to enable more customers to enjoy 5G comfortably. By improving area coverage across Japan, we will also contribute to targets by the government's Vision for a Digital Garden City Nation. In 5G, arenas to bring about new value will expand with full-scale of Stand-Alone (SA) development. Network slicing will bring steady communication for each use case and openness and virtualization will also advance network operations. We have been behind other nations in terms of 5G deployment, but now we will proactively introduce 5G as well as its usage scenes with an eye to the times beyond 5G.

For the 5G Penetration, we will set the medium-term target of 80%, aiming to increase communications ARPU revenues in the fiscal year ending March 2025 to exceed that of this fiscal year ended March 2022. To achieve early ARPU growth, we will strive to maximize ARPU. We will also expand services through partnering, which is our strength, and provide experiences unique to 5G. We will provide leading entertainment OTT services with worry-free unlimited data usage, super-definition videos and real-time services.

Focus areas

(1) DX

The center of the growth for the focus areas is the corporate business of DX. In the NEXT Core business, we will aim for double-digit growth in sales CAGR, making the Business Services segment the second pillar of growth after telecommunication, raising its operating income CAGR by double digits and making it account to about 20% of our group's consolidated operating income. To do that, we will capitalize on our strengths and advance the optimized operational management know-how toward the time when telecommunication will reach every corner of society. We will provide new value with our partners through 5G and DX, as well as through stabilizing the operational and maintenance management structures developed over the years with our global partners. In the future, we will combine our extensive assets such as ID management, payment, and data analysis developed through our telecommunication operations and consumer businesses, with guaranteed bandwidth based on 5G network slicing, proposing solution cases that tailored to each industry, to accelerate the DX of our corporate customers. We will also launch successful domestic DX models worldwide, based on our sales structure that unites our domestic and global sales prowess.

(2) Finance

In the finance business, we will aim to increase key indexes, as well as achieve double-digit growth in sales and operating income CAGR, mostly through growth drivers including home mortgages and the number of credit card members, while interlinking wide-ranging features and services from the finance group, and encourage customers' use of these services and functions across different channels. In the future, we will launch B-to-B-to-X services by providing platforms for au Financial Group's Banking as a Service (BaaS) to non-financial business operators, to make BaaS accessible for customers, employees and store operators beyond, expanding our business domains. Just as in telecommunication, we will aim to provide new added value by offering financial services to every corner of society.

(3) Energy

In the energy business, we will aim for double-digit growth of sales CAGR in the medium term through steadying income and expanding the customer base. We will also launch new carbon-neutrality-related businesses. We will look to providing renewable energy, strengthening our prowess to adjust supply-demand to address the fluctuations in the supply-demand balance arising out of the growth of renewable energy, advancing our VPP business.

(4) LX

In LX, we will create the businesses of the future through 5G penetration and technological advancement that will reform people's experiences and activities in their daily lives. To do that, as advanced technologies for the Beyond 5G and 6G era, we will focus our efforts into LX technologies from the consumer's perspective, such as networks, security, space recognition, image analysis, and AI. For the Metaverse, which is one of the examples of value created by LX, we will create spaces in which everyone can express themselves toward the Web3.0 era in which users can directly own and share contents with each other. For drones, we will launch services that will revitalize regional areas and people's lives, including unmanned delivery and augmented video experiences. For satellite communication, we will bring city-level communication quality to mountains, camping sites and remote islands, through partnering with SpaceX, thereby contributing to creating new experiences.

(5) Region Co-Creation

We will deal with problems in regional communities and create together with the communities. We will work on eliminating a total of 15 million digital-divide cases in the medium term.

We increase the sales of the focus areas to account for over 50% of consolidated sales by growing the businesses in these focus areas.

Initiatives to strengthen our management foundation

First, we will transform into a company that puts human resources first. We will advance three-in-one transformation initiatives, with a new personnel system, internal DX, and work-style reforms. We will spread the KDDI version of the job-based human resource system to enable diverse people to utilize their talents to the full and to advance diversity and inclusion. To drive business strategies based on DX, we will develop all employees to be professionals and improve their DX skills through "KDDI DX University," shifting personnel to focus areas.

For carbon neutrality, in February 2022 the KDDI Group obtained SBT certification in an international initiative "SBTi." To accelerate carbon-neutrality initiatives, we will achieve carbon neutrality in fiscal 2026 for data centers and in fiscal 2030 for KDDI alone, bringing the initial target forward by 20 years, and by fiscal 2050 for the entire group. To save energy, we will work on the efficient development of 5G areas, implementing AI control in stations, sharing facilities, and bringing immersion cooling into data centers

All KDDI Group board members and employees will respect for the "KDDI Group Human Rights Policy," ensuring due diligence for human rights, including in supply chains and global businesses, thoroughly respecting human rights in our business activities. As we welcome more group companies and our businesses diversify with the advancement of the Satellite Growth Strategy, we will strengthen our group's risk management and information security systems.

For cost efficiency, in technology-related areas, accelerating 5G roll-out to more areas, we will appropriately control our investment criteria, including through promoting the sharing of infrastructures and by using advanced technologies. We will also work on transforming our sales structure and making our sales channels more efficient to save about 100 billion yen of costs in the medium term.

For cash allocations, we will continue to enhance investment in growth areas and returns to shareholders for sustainable growth. For operating CF excluding financial business, we will aim for about 5 trillion yen in the medium term. The generated operating CF will be first allocated to capital investment for 5G, focus areas, and strategic businesses on a scale of 2 trillion yen in total. We will also provide returns to shareholder of about 1.5 trillion yen in the medium term, through dividends and share buybacks.

Summary of the mid-term management strategy

For sustainability, we will aim for continuous growth of society and the enhancement corporate value together with our partners, through promoting the Satellite Growth Strategy, and by strengthening the management foundation that supports them.

For business growth, we will aim for continuous growth through increasing ARPU revenue from driving 5G, achieving profit growth of over 100 billion yen in focus areas, and by saving cost by about 100 billion yen.

In financial policies, we will prioritize capital investment into 5G and focus areas, and investment into strategic businesses, aiming for over 40% of dividend payout rate, dynamic share buyback, and continuing to achieve 1.5-fold growth of EPS from the fiscal year ended March 2019.

We will strive to transform our businesses amidst unsteady world affairs and rapidly changing business environment.

- Recommended Contents

-